new jersey consumer fraud act real estate

The CFA provides for a mandatory award of. Connected to the sale or advertisement of goods services or real estate to the general public consumer fraud is any conduct that is.

And 3 provide an incentive for competent attorneys to handle consumer protection matters.

. The most common claim made against real estate brokers and agents in New Jersey is an alleged violation of the New Jersey Consumer Fraud Act the CFA. Beyond their clients the Consumer Fraud Act can impact their advertising and sales. New Jerseys UDAP law called the New Jersey Consumer Fraud Act is particularly strong.

This article explores the CFAs application to parties involved in. You need to enable JavaScript to run this app. 568-1 et seq raises an eyebrow as the Act provides for treble damages attorneys fees filing fees and reasonable costs of suit should the plaintiff prevail.

On September 17 2013 the New Jersey Supreme Court affirmed the decision of the Appellate Division which reversed the Trial Court decision dismissing a Consumer Fraud action filed against a large residential landlord and an attorney-employee for charging. The claim accrues on the date of the act or omission. Says that anyone who insert relevant parts of NJSA.

Internet Dating Safety Act. Specifically defendants allegedly used by means of an affirmative act an unconscionable commercial practice deception fraud false pretense false. There is much confusion around how the CFA applies to real estate.

Supreme Court Rules on Consumer Fraud Action Against Landlord for Charging Attorneys Fees for In-House Counsel. Operation simulating governmental. NJ Department of Law Public Safety Division of Consumer Affairs Location.

124 Halsey Street PO. The safe harbor provision is met by showing the realtor made a reasonable inquiry that includes obtaining a Seller Disclosure or a report by a licensed. 1 a material misrepresentation of a presently existing or past fact.

The New Jersey Consumer Fraud Act is one of the strongest consumer protection laws in the nation. First Alternative Affirmative Act. Although every effort is made.

You need to enable JavaScript to run this app. For example section 568-2 discusses how real estate agents can commit fraud in their advertisement and sales. CFA is frequently pled in real estate disputes.

In New Jersey the elements of common-law fraud are. The NJ Consumer Affairs department outlines the specifics of the act. 568-1 et al is meant to protect innocent consumers from fraud deception false promises Call Us.

New Jersey Consumer Fraud Act. Predatory Towing Prevention Act. There are three general requirements to qualify for relief under the CFA.

The New Jersey Consumer Fraud Act codified at NJSA. The Act was intended to give consumers a powerful weapon to fight against fraudulent and deceptive business practices. Identity Theft Prevention Act.

Consumer Fraud Act NJSA. 2 punish and deter fraudulent business practices. Knowing concealment suppression or omission of any material fact with the intent that others.

1 affirmative misrepresentations 2 knowing omissions and 3 certain regulatory violations. That power comes from a provision in the law permitting the consumer to recover treble damages reasonable attorneys. It was enacted in 1960 with three purposes.

5682 NJCFA provides that the act use or employment by any person of any deception fraud false pretense false promise misrepresentation. You must prove that the defendant engaged in an unlawful act. Prepaid Telephone Calling Cards.

The New Jersey Consumer Fraud Act CFA protects consumers against unconscionable and fraudulent practices in the marketplace. Public Movers and Warehousemen Licensing Act. Since Hurricane Sandy we have seen contractors who have committed one - and often - all three types of.

Unconscionable commercial practice Deception or fraud False pretense False promise or misrepresentation or. Under the New Jersey Consumer Fraud Act CFA citizens can bring legal action against entities or individuals who sell goods services or real estate alleging deceptive marketing practices. 4 reasonable reliance thereon by the other person.

The Act provides a safe harbor provision if shown that the realtor had no actual knowledge of the false misleading or deceptive character of the information. 568-2 or other specific statute or regulation commits a consumer fraud. Vehicle Protection Product Warrantors.

New Jersey provides a 4 year limitations period to file suit for breach of contract involving the sale of goodsmerchandise under the Uniform Commercial Code. Quite simply the New Jersey Consumer Fraud Act would apply to realtors as those selling vehicles selling products selling furniture selling service or those engaged in the sale of goods and services in the stream of commerce. The following provides an overview of CFA law in New Jersey as it relates to real estate licensees.

New Jersey Statutes Annotated NJSA published by Thomson West provides the official annotated statutes for New Jersey. The New Jersey Consumer Fraud Act applies to realtors. The New Jersey Consumer Fraud Act provides New Jersey consumers with extensive protection from deceptive and fraudulent business practices.

In connection with the sale or advertisement of merchandise services or real estate the CFA forbids as unlawful conduct the act use or employment by any person of any unconscionable commercial. Show 4 less. Under the New Jersey Consumer Fraud Act the CFA a home improvement contractor commits an act of consumer fraud in any one of three ways.

1 compensate the victims. The statutes in PDF form provided on this website by the Division of Consumer Affairs are unofficial courtesy copies which may differ from the official text. The Consumer Fraud Act NJSA.

Six Year Statute of Limitations for Fraud Claims New Jersey has a six year statute of limitations for fraud. Fox Rothschild LLP Attorneys at Law. 568-1 et seq.

New Jersey Department of Law Public Safety Division of Consumer Affairs. Or real estate as unlawful practice. For defense attorneys and our clients any pleading which contains a count under the Consumer Fraud Act NJSA.

And 5 resulting damages. The New Jersey Consumer Fraud Act NJSA. 2 knowledge or belief by the defendant of its falsity.

It is illegal to attempt to. The New Jersey Consumer Fraud Act defines consumer fraud as any unconscionable commercial practice deception fraud false pretense false promise or misrepresentation in connection with the sale of goods services or real estate. The New Jersey Consumer Fraud Act was amended specifically to include the sale of real estate within its powers.

3 an intention that the other person rely on it.

The New Jersey Consumer Fraud Act Has Limits In Commercial Transactions The National Law Review

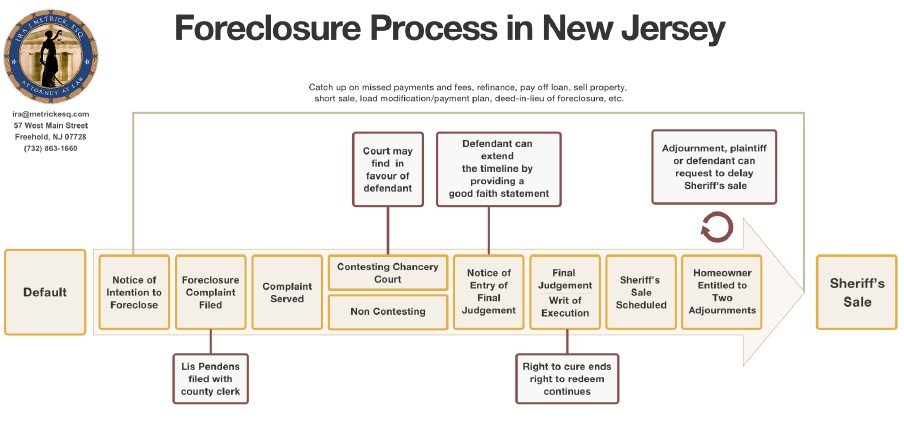

Updated 2022 New Jersey Foreclosure Timeline Ira J Metrick

The New Jersey Insurance Fair Conduct Act Lewis Brisbois Bisgaard Smith Llp

Consumer Fraud Lawyers In New Jersey Ssdmd

Consumer Fraud Lawyers In New Jersey Ssdmd

When Does The Nj Consumer Fraud Act Apply To A Sale Of Real Estate

Traditional Product Liability Claims Under New Jersey S Cfa

Defense Of Real Estate Consumer Fraud Act Claims

When Does The Nj Consumer Fraud Act Apply To A Sale Of Real Estate

Consumer Fraud Lawyers In New Jersey Ssdmd

How To Sue Home Improvement Nj Contractors

Reed Smith Handling Boscov S Class Action Over Furniture Deliveries New Jersey Law Journal

New Jersey S Consumer Fraud Act Valid Cfa Claims Kmt

Thomas J Major Attorney At Law Metropark New Jersey Offit Kurman

Home Contractors Inexperience And Negligence May Give Rise To Consumer Fraud Nj Com